Inside EssentiallySports: How a media house became profitable without any VC money

EssentiallySports turned profitable without VC backing, proving digital media success through content, scale, and strategy.

In digital media, the prevailing model for years has involved raising large amounts of capital, scaling staff rapidly, and deferring profitability in the hope of achieving it at scale. Venture capitalists wrote big checks, media companies hired star journalists and built sleek offices, and everyone assumed the revenue puzzle would solve itself once they reached enough scale.

That assumption has proved costly. Once valued at $1.7 billion, BuzzFeed has reduced staff and sold assets in recent years, while Vice Media filed for bankruptcy in 2023 after raising over $1 billion. These companies built large audiences and produced respected journalism, but struggled with the basic challenge of making money.

The pattern is familiar: a promising startup secures major funding, grows rapidly, and then faces the harsh reality of turning content into profit.

Most media ventures end up chasing venture capital for understandable reasons. Content production means hiring experienced writers and editors, which requires substantial investment upfront. Technology platforms and analytics tools add to early costs. Gaining audience share against established players often demands aggressive spending on marketing and distribution, making the gap between upfront costs and eventual revenue even wider. When competitors announce major funding rounds, the pressure to match their pace can be hard to resist.

One digital sports publication saw these same industry challenges and reached a different conclusion. EssentiallySports, which covers major sports for the US market, decided from day one that it would grow without external capital. This wasn't born from an inability to access funding, but from the conviction that venture capital would create the wrong incentives.

"In media, you can either chase investors or chase your audience. We chose to chase our audience first, knowing that sustainable revenue would follow," says co-founder Harit Pathak.

The choice meant accepting slower growth in exchange for complete control over strategic direction. Each expansion phase would be funded by revenue from previous stages, forcing profitability from early operations rather than treating it as a future consideration.

This approach shaped how EssentiallySports operates and grows. They expand only when revenue can support it, with profits reinvested into new content and hiring. Maintaining ownership control means founders make decisions without board oversight. When sports schedules shifted during the pandemic, EssentiallySports could pivot immediately to cover emerging content areas.

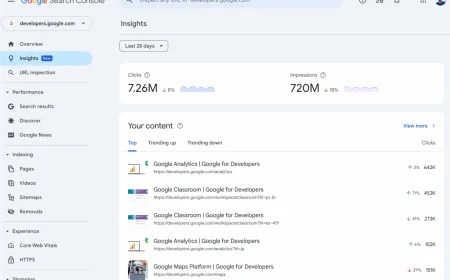

This independence affects all editorial decisions and content choices. Stories get chosen based on audience interest rather than investor preferences for specific demographics or market segments. The company measures success through revenue and profit margins, not page views or social media engagement numbers that look impressive in investor presentations. Data-driven editorial decisions help build audience loyalty. When analytics show strong reader engagement with certain types of analysis or sports coverage, they produce more of that content.

EssentiallySports' revenue model combines display advertising, branded content, syndication partnerships, and partnerships with leagues, plus social media monetization. However, having the same revenue streams as competitors doesn't guarantee profitability.

While many digital sports outlets rely on investor funding to build their audience, EssentiallySports has grown entirely through operational revenue. What makes this model work differently from competitors using similar revenue streams is their focus on cost efficiency and immediate ROI. Technology investments get evaluated on whether they improve efficiency or audience reach. Content investments require proven reader interest before significant resources are committed. This avoids the "burn cash for reach" trap that destroys many digital media startups.

The discipline behind profitability means treating audience growth and monetization as the same job from day one. Every piece of content gets evaluated against both reader engagement and revenue potential. New sports verticals must demonstrate clear monetization opportunities alongside audience demand. This creates daily accountability where mistakes cost money they can't easily replace, forcing careful decision-making across all operations.

"Bootstrapping doesn't make headlines, but it keeps the lights on and the company alive," Pathak notes.

The reality includes founders working longer hours and handling multiple responsibilities that larger organizations split among specialists. Growth happens more slowly than venture-funded competitors. Expansion opportunities sometimes get passed up because the financial model can't support them immediately. But these constraints create operational knowledge and financial discipline that prove valuable during industry downturns.

Looking ahead, EssentiallySports plans to leverage its brand equity to expand into new sports media opportunities while maintaining the same financial discipline. They view independence as their long-term competitive edge, believing that maintaining ownership control and operational flexibility provides advantages as the media industry consolidates around major players and market conditions become more volatile.

For an industry still figuring out how to balance good content with making money, EssentiallySports demonstrates that sustainable media businesses can be built without venture capital—though it requires founders willing to prioritize immediate profitability over rapid scaling, focus on data-driven decisions over vanity metrics, and embrace the grind of hands-on operations rather than delegating to investor-funded specialists.